Over the past ten years or so, fintech (financial technology) has witnessed an exponential transition in terms of accessibility, security, and optimisation.

Thanks to consistent innovation in digital technology, the constantly evolving power of the internet, and a growing increase in the use of mobile devices, we now live in a financial ecosystem where contemporary fintech companies seem to be flourishing. These companies offer a diverse array of real-world solutions aimed at conquering the age-old obstacles dominating the traditional banking industry.

The Blockchain Revolution

When you talk about the prominence of fintech, it is easy to see that one of the most powerful and futuristic innovations brought forth by financial technology is blockchain. Often held synonymous with cryptocurrencies such as Bitcoin and Ethereum, blockchain functions as a distributed database platform, providing users with tamper-proof, lightning-fast, and transparent transactions.

The blockchain universe is consistently developing cutting-edge financial solutions that are designed for enhanced scalability, interoperability, and affordability. But one of the best things about blockchain is that it provides easier and cheaper access to the world of decentralised finance to all levels of traders and investors.

Once joked about by the traditional banking and investing sector as being worthless hype, it is unbelievable how fast blockchain garnered global acceptance, and now stands at the very precipice of the worldwide financial industry.

It’s no wonder why modern financial technology companies are propelling towards building futuristic and highly viable blockchain platforms that provide countless features aimed at offering users the power to conduct virtually all types of trades and transactions in varying contexts.

Incredible Ways Blockchain is Transforming the Fintech Industry

Optimized Financial Services

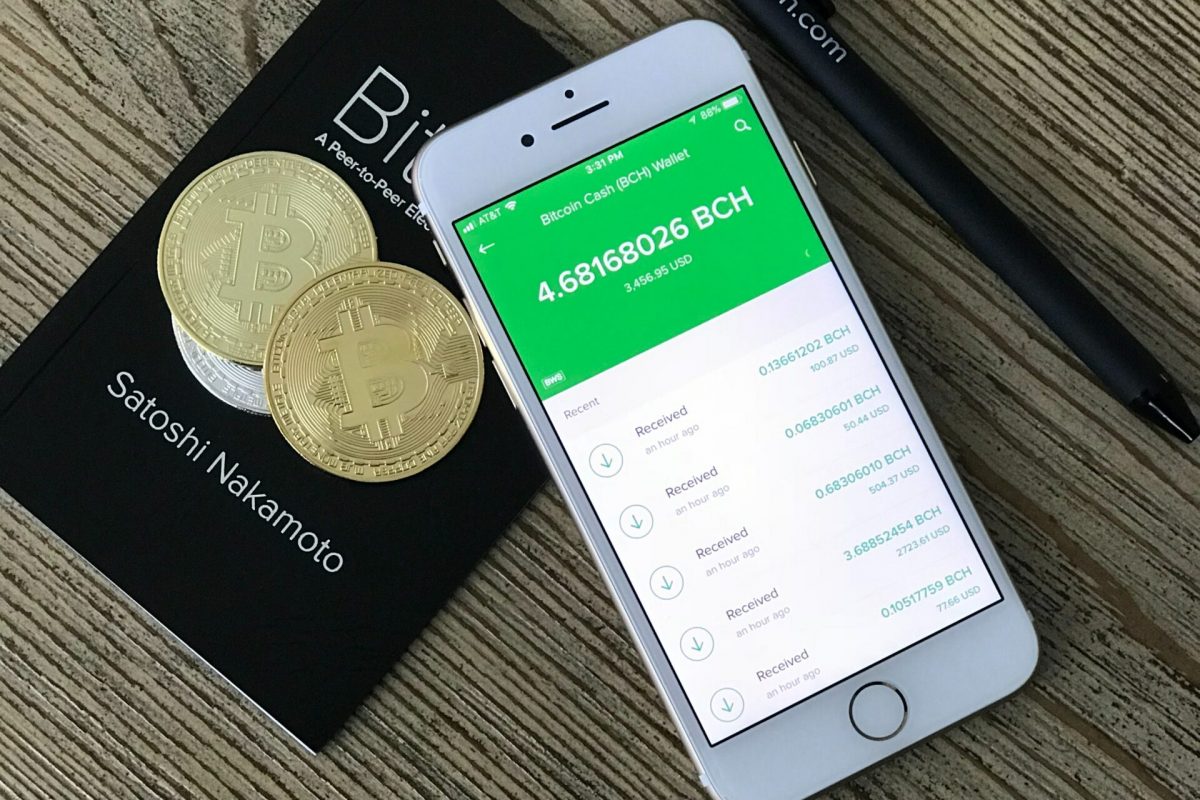

Blockchain is gearing to provide users with highly personalised financial services that can be customized in accordance with specific needs. As a trader on the blockchain, you will have streamlined access to tracking and monitoring your investments and trades, accurately recording your trading performance, and maintaining your cryptocurrencies in real-time.

Exceptional Speed and Growing Cost-Effectiveness

Blockchain technology can offer businesses the ability to conduct trades at considerable speed while helping them save money.

If you start a business and want to start paying operational costs associated with the business, such as bills and taxes, you’re required to get a business licence. Now, applying for a licence can be a long, complex, and frustrating process. On top of that, the financial company will need all the information associated with your banking account.

In contrast, using blockchain to open and register your business could be a pretty straightforward task. Not to mention, it will be quicker because blockchain technology is designed to process information from any viable source without requiring a third-party (middle-man) intervention. With such accessibility, you’ll be able to start a business without wasting time waiting for approvals, filling out forms, etc.

A Transition in the Balance of Control

There’s no question that our wants and needs are continually evolving. Modern consumers, businesses, investors, and traders all demand a more transparent, easy-to-monitor, and open financial platform to manage their transactions. This is one area that traditional financial institutions have been failing to address.

What this also means is that blockchain is leading a revolution to democratise your financial independence. It is disrupting the current traditional financial norms, effectively decentralising all control. Today, users have the opportunity to control and manage their data and financials without relying on (or even needing) brokers and other third-party elements.

For example, people who buy digital currencies such as Ethereum, Bitcoin, Matic, etc. have the option to keep their crypto assets secure in private digital wallets, which only they (and no one else) have access to.

Crypto wallet owners are armed with secure private keys to their vaults, transparently and independently conducting crypto trades without federal and regulatory intervention.

Reduced Operational Costs

Blockchain technology plays a pivotal role in helping businesses lower their operational costs. It achieves this by offering users the opportunity to develop “smart contracts” thereby eliminating human involvement. This can have huge implications for the banking and finance industry, allowing companies to drive down overhead expenses and enhance their yearly profit margins.

Streamlined Transparency

Compared to banking organisations and other financial companies, blockchain platforms have far more transparency. For instance, just as the U.S. Security Exchange Commission has the power and ability to track and monitor even the smallest traces of fraudulent activity and/or insider trading, it can also do the same with blockchain-based entities. Sure, banks also have the ability to trace fraudulent transactions and such, but it takes a lot of time and there are a lot of protocols surrounding it. With blockchain, it is ridiculously faster.

Speedy Business Transactions

With blockchain, transactions that normally take 1-2 days to transpire can now be completed in a matter of seconds. Why? Well, blockchain platforms are designed to operate with increasing autonomy and don’t require annoying third-party verifications. Moreover, all transactions on the blockchain are recorded on a public ledger and as soon as you start a transaction on one blockchain node, the transaction will be carried throughout all blockchain nodes.

Far-Reaching Business Opportunities

While traditional finance and banking companies are equipped to handle large volumes of transactions, they’re riddled with limitations. Blockchain, on the other hand, can provide exponential features and functionalities that will make it easier and safer to process a significant amount of money from sectors like the stock exchange. This is an exponential advantage no traditional company can compete with. Blockchain transactions are fast and transparent because they don’t require any intermediaries.

In addition, Blockchain offers businesses a tamper-proof way of developing secure transactional logs compromising sensitive activity, which makes it exponentially beneficial for businesses that want to conduct international transactions and fund transfers.

With the global acceptance and popularity of blockchain, it is clear that we are living in a fintech revolution that has a promising future. Today, we have the power to control our finances and have better access to trading and investing. This also means that, via blockchain, underprivileged economies will have the opportunity to gradually gain financial independence and prosperity.